Florida Trim Notices - What Do They Mean and Why Are You Receiving Them?

What is a Florida TRIM Notice? Your Guide to Understanding Property Taxes

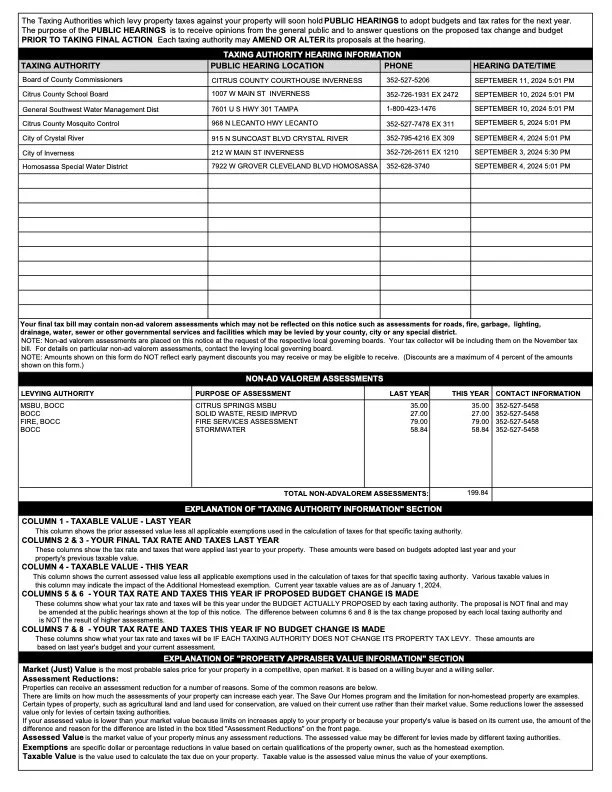

Every year in Florida, a notice arrives in your mailbox that can easily be mistaken for your property tax bill. This is the TRIM (Truth In Millage) notice, and while it looks official, it's not the final bill. Instead, it’s an important document designed to give you a heads-up about your upcoming property taxes.

What's Inside Your TRIM Notice?

Typically mailed in August, the TRIM notice is your chance to review the proposed taxes for the year before they become final. It's a comprehensive overview that includes several key pieces of information:

Proposed Tax Rates: You'll see the tax rates proposed by various local authorities, such as the school board and county government.

Assessed & Taxable Value: The notice shows the assessed value of your home, which is the value determined by the property appraiser, and the taxable value, which is your assessed value minus any exemptions.

Exemptions: It lists any exemptions you are currently receiving, such as the homestead exemption, ensuring your information is correct.

Comparison to Last Year: The notice compares the proposed tax amount to the amount you paid last year, highlighting any significant changes.

Why is it So Important to Review?

Receiving the TRIM notice gives you an opportunity to act. If you notice a significant or unexplainable jump in your property's value or taxes, this is your chance to contact your county’s appropriate office. You can ask for clarification or, if necessary, file an appeal. Taking action at this stage is crucial, as the final tax bill that arrives on November 1st is legally binding and often more difficult to challenge.

Check out the differences between the documents below. Think of the TRIM notice as a vital heads-up, giving you time to review and question your property's valuation before the final tax bill is sent out.

Sample TRIM Notice - Page 1

Sample TRIM Note - Page 2

Sample Tax Bill